Bitcoin, Silver, and Gold in Q1 2018

I want to do a retrospective summary of the relative prices of Bitcoin, silver and gold in 2018. I know it’s a small period of time, but it represents the post-bubble phase of cryptocurrencies. I think it is important to compare the three assets, because they represent alternative investments, which can be held outside the system. Bitcoin can be in an anonymous wallet, gold and silver can be stored under your bed.

There is a common view that the precious metals and bitcoin are in some way at war with each other. Many holders of gold and silver blame cryptocurrencies for the underperformance of their assets. They have sucked the life out of their shiny stacks. Of course a more reasonable analysis is that the precious metals have suffered from dollar strength. Having said that, there does need to be an asset with which to escape the system, and you would not expect gold and Bitcoin to move in the same direction for long periods of time.

The simplest way to compare Bitcoin, gold, and silver is through correlation, though one has to be careful, because one is dealing with time series data, which is vulnerable to auto-correlation.

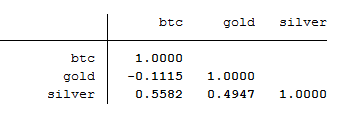

Here is the correlation table:

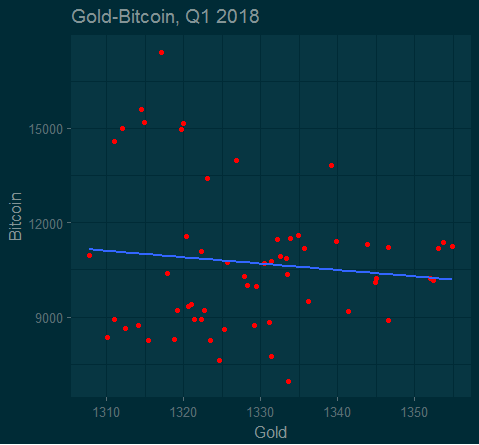

You can see that Bitcoin and gold have a small, negative correlation, which is statistically not significant. Yet both gold and Bitcoin have positive correlations with silver. Does this mean anything? Gold is always correlated with silver, and the correlation of .50 is unusually weak. In fact Bitcoin is more correlated with silver than gold, which reflects the fact that both were falling during the first quarter of 2018. Here’s the gold-Bitcoin scatter plot:

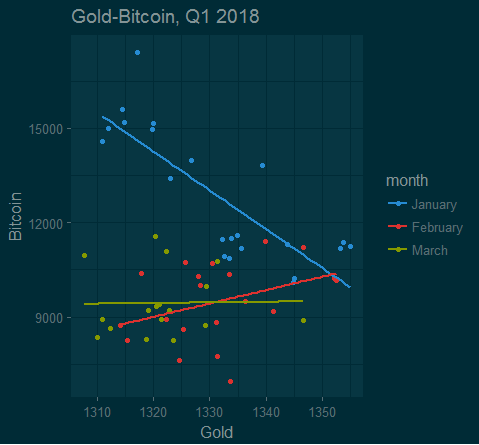

The fit line is pretty flat, and the only reason for the negative slope is the high value of Bitcoin in early January. The graph can be broken down by month:

During January there was clearly a negative relationship between gold and Bitcoin, which disappeared in February and March. So overall, there isn’t much of relationship between the precious metals and Bitcoin. Though I suspect that if cryptos get really smashed, the situation might change. If people realize that cryptos are not a safe haven assect, then precious metals might benefit. You can hide your Bitcoin from the government, but not from the markets.