Guessing the silver price

There’s an old game, where you fill a glass jar with sweets, or candies, and everyone guesses how many are there. The winner keeps the lot. And if you take the average of all guesses, you’ll get a good approximation of the actual amount. I think it’s called the Wisdom of Crowds. The same principle might apply to the markets. If I ask 30 people what the price of silver is going to be on July 31 2020, I just have to take the average guess and position myself accordingly.

There’s an old game, where you fill a glass jar with sweets, or candies, and everyone guesses how many are there. The winner keeps the lot. And if you take the average of all guesses, you’ll get a good approximation of the actual amount. I think it’s called the Wisdom of Crowds. The same principle might apply to the markets. If I ask 30 people what the price of silver is going to be on July 31 2020, I just have to take the average guess and position myself accordingly.

Unfortunately, this assumes that the players in the game are neutral. If you own an asset, the situation is different. I saw this at work over the Summer. On the ADVFN financial bulletin board, there’s a thread called “The Really Useful Silver Thread”. It’s not actually that useful, and many of the posts are about conspiracy theories. Yes, people who invest in the precious metals are suckers for conspiracies, and they believe that markets are manipulated by malevolent forces. Not to mention Goldman Sachs and J.P. Morgan.

Larry Williams, in his book Trade Stocks and Commodities with the Insiders, summed it up succinctly: “The bullish camp, those looking for wildly higher prices, has made a mantra and religion out of silver. To them the world is going to hell and the sooner the better” (p.38).

Still, there is a certain community spirit on the board, and also an annual competition. The prize is two ounces of silver, and you have to guess the silver price by Christmas, with the closest guess being the winner. If my memory serves me correctly, the silver price at the time the competition was open was around $18. The guesses, in dollars, were as follows:

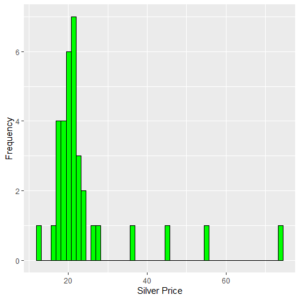

73.29, 55.23, 45.00, 36.37, 27.50, 25.75, 24.00, 23.56, 23.08, 23.05, 22.22, 21.77, 21.75, 21.42, 21.10, 21.00, 20.90, 20.80, 20.50, 20.20, 19.87, 19.85, 19.80, 19.48, 19.20, 19.05, 18.52, 18.30, 18.05, 17.90, 17.55, 17.45, 16.50, 11.95

As the histogram at the top of this post demonstrates, the distribution was far from normal, with the lowest guess of $11.95 being 1.03 standard deviations below the mean, the highest guess, $73.29, being 4.14 standard deviations above.

I suppose the biggest problem with these guesses was personal stake. With the sweet jar one’s guess is neutral. One doesn’t really care how many sweets there are. With silver, there is often total commitment to the cause. The price is manipulated, and one day the manipulation will end. The true price of silver is $50, $75, $100, take your pick. You’re therefore tempted to go for some crazy number. This means, from a rational perspective, that guesses over $27.50 should be discounted. Commodities don’t double in value in the space of a few months, unless there is a global shock.

The mean guess, at $24.16, doesn’t tell us much, because it is heavily influenced by the crazy guesses. The median guess, at 20.85 is more reasonable. If the precious metals market had recovered its steam, after the Autumn correction, we might have reached this price.

Alternatively, we could look at the 95% confidence interval. The high value is 28.31, the low value 20.04. So even the lower bound is totally out of whack, given that today, six days before Christmas, the price of silver is $17.04.

From a rational point of view, if you own silver, it would have made sense to put in a low-ball guess. It would be a possible way of hedging your long silver position. If your longs are underwater, you at least have the consolation of having a real chance of getting $34 of silver, from a competion that costs you nothing to enter.

For myself, I guessed $16.50. The next highest guess is $17.45. I saw a youtube video a few years ago, where someone said that silver below $16.50 is cheap, above $16.50 expensive. It seemed a reasonable estimate. I therefore need silver to close below $16.975 to win my two ounces.

Does the story have a moral? Don’t listen to bulletin boards. And remember that wishful thinking can’t move the markets.