The Dollar and Gold – a dubious correlation

Gold is priced in dollars, so when the US Dollar goes up, gold goes down, right? This relationship between gold and the Dollar is much talked about, and there is a view that as the Dollar rises, so gold falls. In other words, a rising Dollar is toxic for the gold price. The same logic follows for other commodities, such as silver and copper.

The relationship between two things can be measured as a correlation, where two things that move in exactly the same way have a correlation of 1. By contrast, two things that move in perfectly opposite directions have a correlation of -1. In the case of gold, one might expect its correlation with the dollar index to be very negative. But does this negative relationship actually exist?

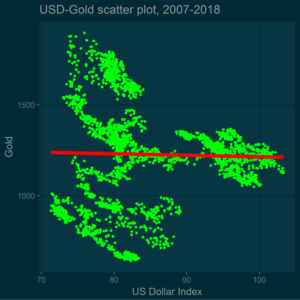

If one looks at the data since 2007, without making allowances for the autocorrelation of time series data, there is no correlation between gold and the Dollar Index. To be precise, it’s -.02. Very slightly negative, but not statistically significant. If one allows for autocorrelation, the correlation does become significant, at -.28. This means that changes in the Dollar Index account for just under 8% of changes in the gold price. In other words, 92% of gold’s movement is unexplained by the Dollar Index.

I suppose one of the main reasons that so-called pundits are currently obsessing about the strength of the gold-dollar relationship is recent history. At the moment, in the first half of 2018, there is a strong negative relationship between gold and the Dollar:

As you can see, the relationship between gold and the Dollar Index is savage, and any rise in the dollar is going to be met with a smashing of gold. The unadjusted correlation is -.72, meaning that over half the variance is shared.

Yet nothing lasts for ever, and the moment a highly correlated relationship seems set in stone, it breaks up. Here’s the graph of the 30-day correlation between gold and the dollar, since the beginning of 2016:

Right now the correlation between gold and the dollar is at an extreme low, of -.92. It’s therefore got nowhere to go but up. This has consequences for anyone who is both long the Dollar and long gold. At the moment it’s a hedged trade, but for how long will it stay that way?