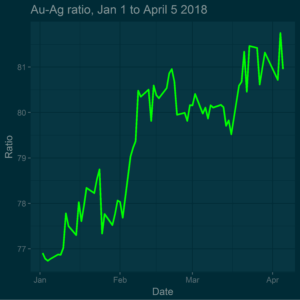

Gold-silver update, April 5 2018

Today there is a bit of divergence in gold and silver – gold is down a bit, at 1325.20, silver up a bit, at 16.37. This perhaps reflects what the talking heads are saying, that silver, having underperformed gold, is due for a rise. Indeed some serious commentators are suggesting that silver could return to its 2016 highs, within months rather than years. As for the gold-silver ratio, it is still sky-high. Yesterday, at 81.75, it was the highest it has been for two years. Today it’s down to around 80.95. Of course a falling gold-silver ratio isn’t necessarily bullish for silver – it might just mean that silver is falling less than gold. Yet there is historical evidence to suggest that when the gold-silver ratio spikes, a rise in the silver price soon follows. This is because silver tends to follow gold, and when gold makes its move, without silver following, the ratio can temporarily hit very high levels.

We should also remember that silver is a hybrid metal. It is a precious metal with many industrial uses. Today’s small rise in silver may just reflect what is going on with the base metals. Copper, for example, is up over 1%, at $3.08 a pound.